Are you a rookie in the investment world who has been looking for some Investment Tips For Beginners? We guess your answer is yes. If so, you will be pleased to know that you spotted the right platform to gain some Stock Market Tips For Beginners.

A beginner trader or investor must understand that no matter how experienced they are in investing, they can always make mistakes at times and can never accurately predict market behavior. Investing is along as well as a risky game. Regardless of your goal for investing, you are best advised to set it or forget it.

Whether you are investing in buying a car, a new house, or foreign studies, you must remember it will take time to get fruit out of it. Finladder is a well-established finance educational firm founded by Mr. Ishaan Arora that helps experienced, and beginner investors make the most out of their investments. We have compiled a list of Investment Tips For Beginners.

Investment Tips For Beginners

Do your study – You can not invest without proper research. One must be very familiar with investment terminology such as Demat account, portfolio buildin, mutual funds, stock exchange, Price-To-Earnings (PE) Ratios, PEG Ratios, Dividend-Adjusted PEG Ratios, Dividend Yield, Derivative, etc. It would help if you did your research regarding the stock you choose to invest in.

To learn better about stocks that you invest in, you can read the company’s annual reports and thoroughly research their services and customer experience. To sum up, you must know the Basics Of Investing before making any investment.

Some Investment Help – When we are saying investment help, then we didn’t mean that you can take some investment tips just liike that. All we are saying is to study some good platforms such smallcase, tickertape etc.

Because they made the financial terms easier to understand for the freshers. And even when we are talking about the Smallcase, then it can be the fantastic way to start investing. Because they have created various basket for as per your requirements and budget. Basically they are following the rule never put your all eggs in one basket.

Realize Your Time Horizon –

- Everyone has varied investing objectives:

- Saving for retirement.

- Paying for your children’s college tuition.

- Saving for a down payment on a home.

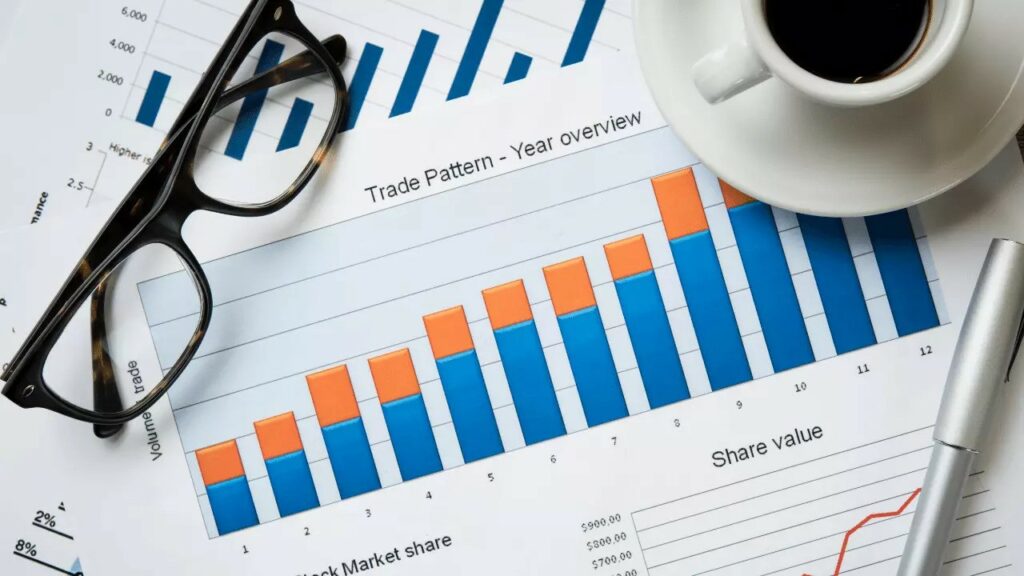

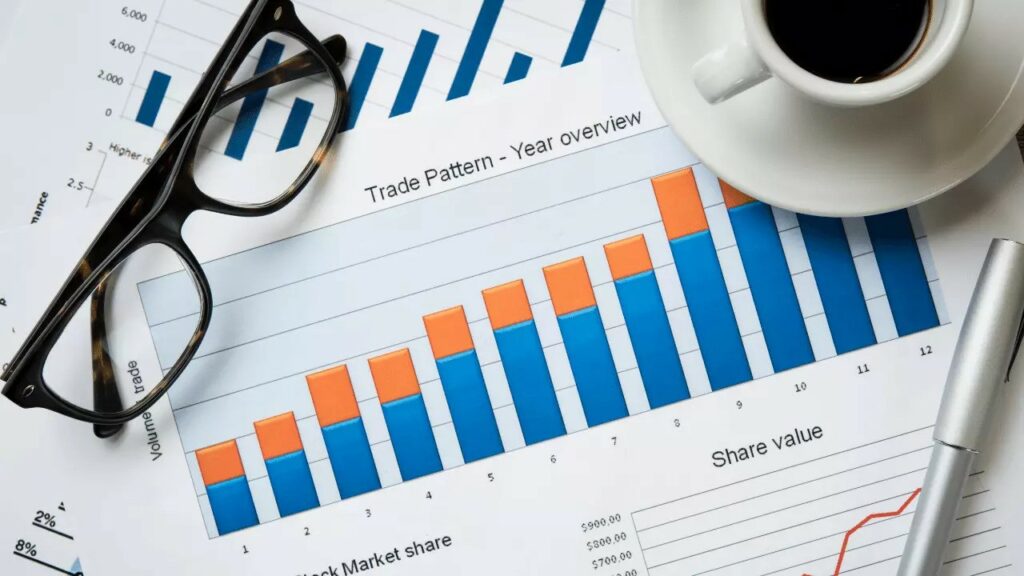

Understanding your time horizon, or how many years before you need the money, is critical to all long-term investing, regardless of the goal. Long-term investing is usually defined as five years or more, but there is no hard and fast rule. You will have a better notion of what investments to make and how much risk you should take if you know when you will need the money you are investing.

Finance Courses – Take charge of your financial training. Mr. Ishaan Arora may help you improve your financial literacy by teaching you about corporate finance, risk management, mergers and acquisitions, pricing models, and money markets. With online finance programs from renowned schools worldwide, you will learn more about transaction structures, economic policy, financial decision-making, and more.

Finladder “One Of India’s Best Financial Firms” offers several online courses that can help you build your financial knowledge. Finladder’s financial courses include various finance courses in which NCFM Course Online, Stock Market Course Online, Equity Research training are few of the major ones. Ishaan Arora founds Finladder, through which he creates finance awareness by sharing his techniques across India as well as overseas.

Start With A Financial Plan In Mind – You must first determine how much money you have to make long-term investments. This entails having your financial affairs in order. You can always begin by analyzing your assets and liabilities, developing a fair debt management strategy, and determining how much you will need to build an emergency fund.

By completing these financial duties first, you will be able to put money into long-term investments and avoid withdrawing funds for a time. We believe that everyone should be aware of this one of the foremost Golden Rules Of Investing.

Recognize The Risks Of Investing – To avoid knee-jerk reactions to market declines, make sure you understand the risks of certain assets before investing in them. Stocks, for example, are generally thought to be riskier investments than bonds.

We suggest decreasing your stocks allocation as you get closer to your goal. As you get closer to your deadline, you may lock in part of your winnings. Even within equities, though, certain investments are riskier than others.

Furthermore, Bonds may be less risky, but they are not still risk-free. Corporate bonds, for example, are only as safe as the issuer’s bottom line. If the company goes bankrupt, it may be unable to pay its debts, forcing bondholders to bear the loss.

To reduce the danger of default, invest in bonds issued by corporations with excellent credit ratings. However, assessing risk is not always as straightforward as looking at credit scores. Therefore, investors must also consider their risk tolerance or how much trouble they can take before investing.

Conclusion

The final piece of advice, or one of the best Investment Tips For Beginners, is to invest in substantial corporation stocks. In the beginning new traders should invest in the top 200 firms since they are a secure investment. This will ensure that you do not buy low-quality more risker stocks and instead invest in the best ones, yielding high returns.

Since the dawn of time, equities have aided in creating long-term wealth for investors. Many people have benefited greatly due to this since they have been able to attain their financial goals with ease. However, mindset is the key to making money in the markets. If you follow the aforementioned Stock Market Tips For Beginners, you will do well in the markets and build wealth for your future ambitions.